Posts From Fintech News Malaysia

Touch ‘n Go First E-Wallet to be Approved by SC to Offer Investment Products

Touch ‘n Go (TNG) Group’s subsidiary TNG Digital Sdn Bhd (TNGD), has emerged as the first e-wallet to be granted a conditional approval to operate as a Recognised Market Operator (RMO) by the Securities Commission of Malaysia (SC). TNG said

Read MoreP2P Lender microLEAP Receives RM3.25 Million Funding From MAA Group

microLEAP, Malaysian platform that offers both Islamic and Conventional Peer-to-Peer (P2P) financing, announced a successful RM3.25 million funding round, made up of RM1.25 million in equity and a RM2 million advance. The RM3.25 million will be used for advertising and

Read MoreHuawei and IDC’s Banking Resilience Index Uncovers How FIs Responded to COVID-19

A new whitepaper by Huawei and the International Data Corporation (IDC) looks at how banks around the world have responded to the COVID-19 pandemic and identifies the way forward in the new normal. In a report titled Banking Industry Rises

Read MoreSoft Space Deepens Push into Japanese Market with GMO Partnership

Malaysian fintech startup Soft Space has announced that it has partnered with GMO Financial Gate (GMO-FG), a Japanese payment service provider, to introduce payment solutions within the Japanese market. With this partnership in place, Soft Space will be able to support

Read MoreFinancial Services Need to Reinvent Itself for Malaysia’s Growing Gig Economy

In Malaysia, the gig economy has been growing rapidly, especially at a time when the COVID-19 pandemic is forcing people to turn to temporary work to secure income. Despite this rapidly growing segment, freelancers, self-employed and gig workers are still

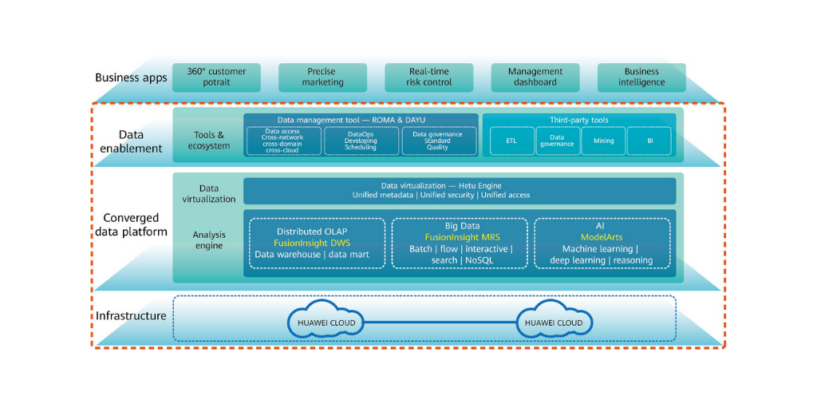

Read MoreFinancial Institutions Turn to Huawei’s Converged Data Lake Solution to Accelerate Banking Innovation

Like many other areas of the economy, the financial services sector is undergoing a data revolution. Every day, the global banking industry generates massive amounts of data by processing hundreds of billions of financial transactions as well as through interactions

Read MoreBank Negara Malaysia To Issue up To 5 Digital Banking Licenses in 2022

Bank Negara Malaysia issued on 31st December 2020 the much anticipated digital banking framework, which followed a six month public consultation period. Plans for a digital banking framework was first announced in March 2019 and were initially scheduled to open

Read MoreYear End Message to Our Readers – Offline from 24th December to the 3rd January

Fintech News Malaysia would like to take this opportunity to wish all our readers a Merry Christmas and a very Happy New Year. We will be taking a break from the 24th December 2020 to the 3rd January 2021. Until

Read MoreHow Data Privacy Affects Engagement in Financial Services

It may be a challenge for brands in highly-regulated spaces, but meeting customer expectations is both possible and essential. To get there, marketers need to ensure that they strike the right balance between data privacy/security and innovation. Let’s explore the

Read MoreHow to Get Customer Messaging Right in Financial Services

If fintech brands aren’t mindful of today’s looming threats, they may find themselves losing out not just to banks, but to non-financial brands. Think Apple’s wildly successful credit card debut, with over $10 billion dollars of extended credit within two

Read More