Financial Institutions Turn to Huawei’s Converged Data Lake Solution to Accelerate Banking Innovation

by Fintech News Malaysia January 5, 2021Like many other areas of the economy, the financial services sector is undergoing a data revolution. Every day, the global banking industry generates massive amounts of data by processing hundreds of billions of financial transactions as well as through interactions including emails, video communications, call logs and mentions on social media.

Banks are using this data to develop new products and services that are more personalized and which better fit customers’ digital lifestyle.

COVID-19 has accelerated the digitalization of the banking industry, further increasing the amount of data. This huge growth in data creation is bringing both opportunities and challenges for banks and financial institutions alike, which are now forced to adopt new IT capabilities to support innovation.

Data warehouses limitations

Data warehouses are central repositories of well-structured data gathered from diverse sources. This data has already been cleansed and categorized, and is now stored in complex tables.

Data warehouse systems have long been an important part of enterprise IT architecture, playing a critical role in traditional supervision and reporting, as well as in business intelligence.

But now, with mobile technologies advancing and banking services becoming more and more integrated into customers’ everyday lives, users are generating tons of unstructured data that banks must somehow manage to collect and process.

This explosion of unstructured data is posing challenges for organizations, which are now realizing that their traditional data warehouses are becoming unfit to address this new data-driven banking landscape.

For one, data warehouses are expensive and can cost medium-sized banks millions of dollars in investment each year. For a large bank, this figure can reach tens of millions.

In addition to this, they lack real-time analysis capabilities, which, coupled with the increase of both data volume and user scale, means that they can no longer meet service level agreement (SLA) requirements, including real-time anti-fraud measures.

Traditional data warehouses are also mostly relational databases and lack diverse computing capabilities, and are weak when it comes to processing semi-structured and unstructured data.

Not only that, but they are also unable to offer online capacity expansion, posing a real challenge to service continuity when the time comes to increase capacity.

Finally, since they use an all-in-one architecture, traditional data warehouse platforms fail to meet banks’ strategic requirement for IT architecture platform decoupling.

The appeal of data lakes

Evidently, data centers and their related infrastructure are now more important than ever, and their role has evolved from just being storage platform to now playing a crucial part in bank’s digital transformation, driving business expansion.

Around the world, financial institutions are turning to converged data lakes to help them process massive, diverse data and support data-driven service innovation.

Essentially, data lakes are large collections of data from many, and often dissimilar sources that span an entire organization. This data is stored in a more natural form, which helps in collecting data from various sources and structures.

While data warehouses are suitable for structured data, data lakes, on the contrary, are suitable for both structured data and unstructured data such as logs, images, videos or documents. Data lakes are also suitable when data volume is large.

With data lakes, companies can store their data as-is, without having to structure it first. They are also able to run different types of analytics ranging from dashboards and visualizations, to big data processing, real-time analytics, and machine learning (ML) to guide better decisions.

Huawei’s Converged Financial Data Lake solution

To address the financial services industry’s rapidly evolving IT needs, Huawei has been working with ecosystem partners to provide end-to-end data plane solutions tailored for financial customers.

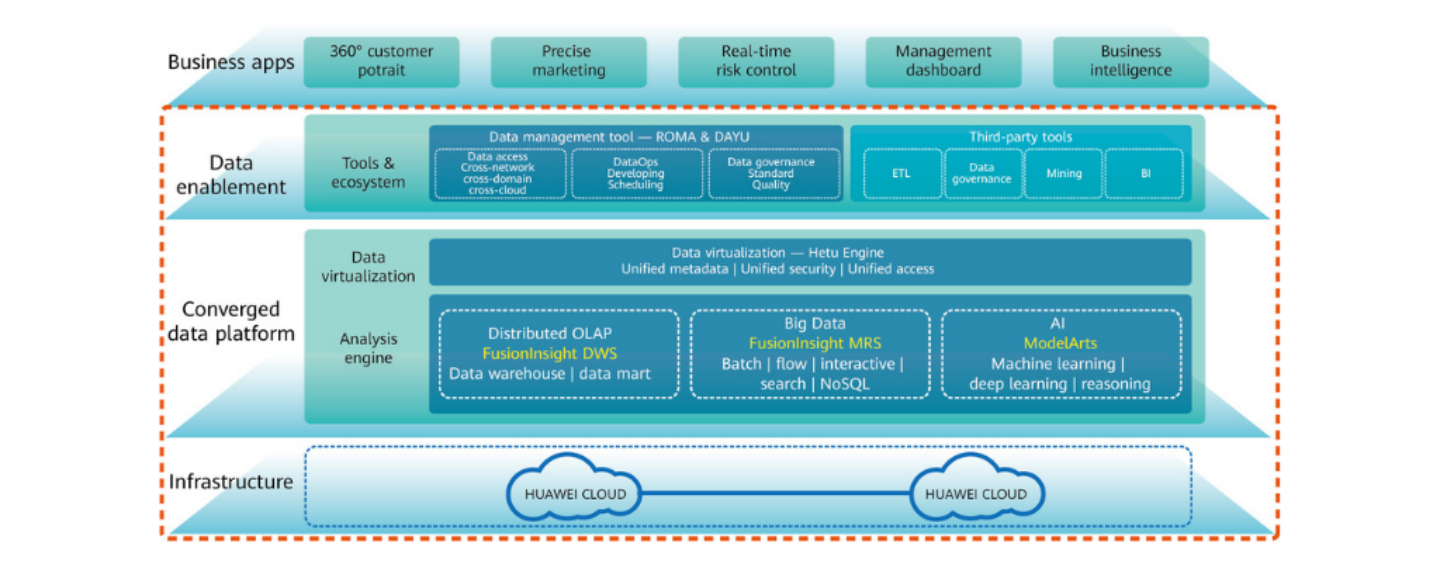

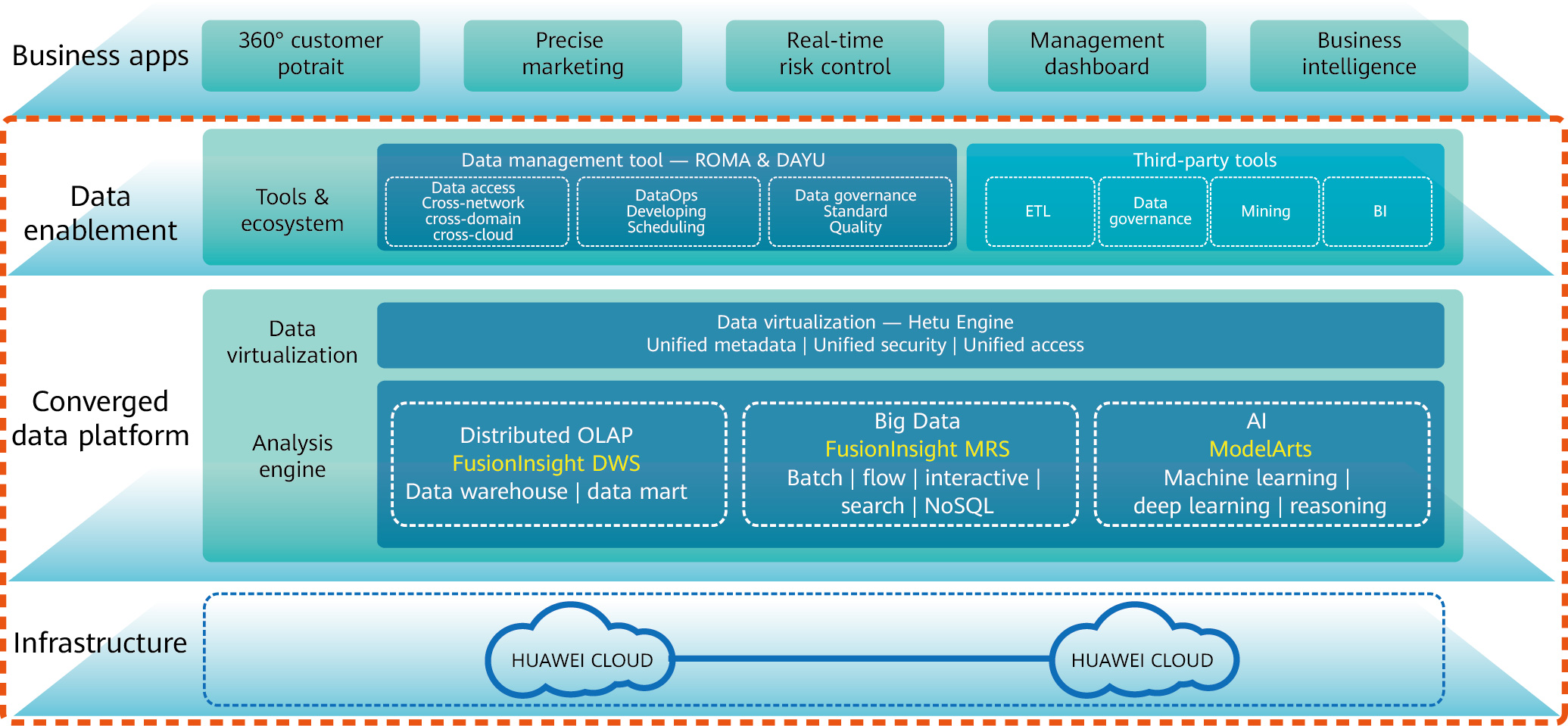

The information and communications technology (ICT) giant is currently the only vendor in the industry to provide a converged data lake solution that integrates a distributed data warehouse platform (FusionInsight DWS), a big data platform (FusionInsight MRS), an AI development platform (ModelArts), and a distributed storage solution.

Huawei Converged Data Lake Solution, illustration via Huawei

Huawei’s Converged Financial Data Lake solution effectively helps banks overhaul and reconstruct their capabilities to offer precise customer acquisition tools and real-time risk controls. The solution also helps banks build leaner operations in front, middle, and back offices, and allows them to intelligently craft personalized products and experiences for their own customers.

Around the world, an increasing number of financial institutions are embracing the open distributed architecture to help them decouple software from hardware, provide them with processing capabilities for massive amounts of data, and support their linear platform expansion.

To find out more about Huawei’s solution for data infrastructure, please check here.