Regtech/Regulation

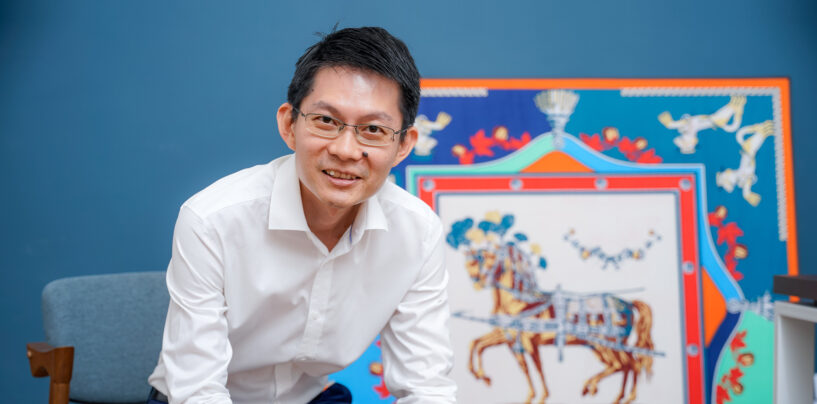

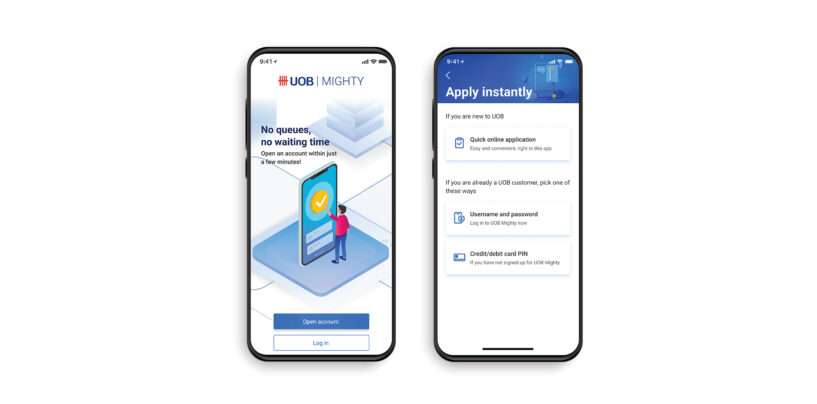

UOB Malaysia Rolls Out in-App Digital Account Opening

UOB Malaysia announced the launch of a digital account opening service that enable customers to open a personal bank account anytime, anywhere via the bank’s UOB Mighty app. The bank said that its customers can now complete the onboarding process

Read MoreInnov8tif’s eKYC Solution Granted Patent to Verify Malaysian IC Microprints

The Intellectual Property Corporation of Malaysia (MyIPO) has granted Innov8tif Solutions a patent for its method of verifying the authenticity of a Malaysian identity document using a computer vision algorithm known as microprint detection technique. Microprint is a security feature

Read MoreHow Securities Commission Malaysia Balances Innovation and Risk in Regulating Fintech

Innovation in fintech is happening at breakneck speed and for entrepreneurs to be able to thrive and introduce these innovations, the right environment has to be set in place. This unenviable task often lands on the desks of regulators who

Read MoreeKYC Startup WISE AI Receives Funding From Sunway’s Venture Firm Sun SEA Capital

WISE AI, a startup providing eKYC and digital identity solutions, has raised an undisclosed amount of funding from Sun SEA Capital, a venture capital backed by Sunway Group. This news follows Bank Negara Malaysia’s approval of the eKYC framework in

Read MoreBanks Should Turn to Using AI in eKYC in the Digital Arms Race

There’s an old joke on how on the internet nobody knows that you’re a dog, which speaks to how the internet has become synonymous with anonymity. While anonymity is fine in many instances, in an increasingly digital world it has

Read MoreMyCash Money Picks Onfido to Power its eKYC

Onfido bags MyCash Money as its latest customer in the region, providing the company identity verification and authentication services. Besides MyCash, Onfido also counts fintechs like BigPay and MoneyMatch among its base of customers in Malaysia. MyCash Money, is an

Read MoreSecurities Commission Inks Fintech Cooperation Agreement With OJK Indonesia

The Securities Commission Malaysia (SC) signed a fintech cooperation agreement with Indonesia’s Otoritas Jasa Keuangan (OJK) to establish a collaborative framework to develop the fintech ecosystem in both markets. OJK Indonesia is an Indonesian government agency that regulates and supervises

Read MoreSecurities Commission and Bursa Malaysia Sets up a Regulatory Subsidiary

The Securities Commission Malaysia (“SC”) and Bursa Malaysia Berhad (“Bursa Malaysia”) announced Tuesday that Bursa Malaysia will establish a wholly-owned subsidiary (“Bursa RegSub”) to assume the regulatory functions currently undertaken by Bursa Malaysia. SC’s chairman, Datuk Syed Zaid Albar shared

Read MoreBNM Issues e-KYC Exposure Draft for Money Changers

Following the introduction of e-KYC guidelines for remittance companies in 2017, Bank Negara Malaysia issued an exposure draft which expands similar e-KYC guidelines for money changers in Malaysia. The draft outlines proposed mininum requirements and standards that a licensed money

Read MoreWhy BNM’s Open API Initiative Could Bring Malaysia’s Fintech into a New Era

Bank Negara Malaysia just released a proposed guideline for Open APIs in Malaysia, and is currently seeking feedback from the public. This follows Bank Negara Malaysia’s announcement earlier this year that it would be setting up an implementation group in the first

Read More