Security

Maybank Halts RM6.4 Million in Potential Scams Through Branch Efforts in 2023

Maybank successfully prevented financial losses amounting to RM6.4 million for its customers in 2023, targeting scams executed via its branch channels. The bank has issued a reminder urging customers to remain vigilant against scam attempts. This includes being wary of

Read MoreMalaysian Minister Azalina Proposes ‘Kill Switch’ Legislation to Halt Online Scams

The Malaysian government is deliberating on introducing new legislation for a ‘kill switch’ that would empower authorities to instantly halt scam activities across all online platforms in the country. Datuk Seri Azalina Othman Said, Minister in the Prime Minister’s Department

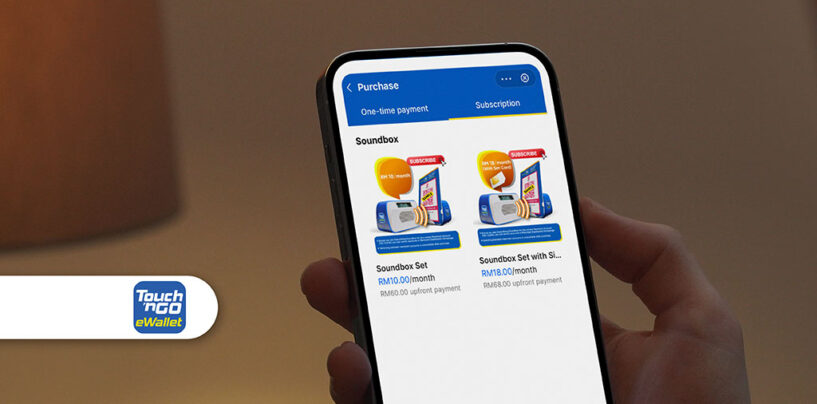

Read MoreTouch ‘n Go eWallet Offers Soundbox to Help Merchants Fight Scams From RM10/Month

TNG Digital has launched a new Soundbox device aimed at protecting merchants from payment scams through the Touch ‘n Go eWallet platform. The Soundbox device is available to merchants in two subscription models: a basic version for RM10 per month

Read MoreBNM and CyberSecurity Malaysia Sign MoU to Bolster Cyber Resilience in Financial Sector

Bank Negara Malaysia (BNM) and CyberSecurity Malaysia have formalised a Memorandum of Understanding (MoU) aimed at reinforcing cybersecurity in Malaysia’s financial sector. This collaborative effort aims to develop and implement comprehensive cybersecurity strategies to address the challenges posed by the

Read MoreTOPPAN IDGATE Boosts Trust With Digital Identity Solutions for Banks

Effective digital identity solutions for banks are essential to prevent fraud and spoofing. This becomes intertwined with Anti-Money Laundering (AML) and behavior analysis in recent times. As we navigate this evolving landscape, staying up to date with trends becomes important. The

Read MoreRHB-PayNet’s Sound Box Delivers Instant Audio and Display Alerts for QR Payments

RHB Bank, in partnership with Payments Network Malaysia (PayNet), has launched the DuitNow QR Plug & Play sound box in a bid to step up payment security. According to RHB, it is the first bank to introduce the device. This

Read MoreEvolving Mobile Threats Brings Rise to New Multi-Layered Applications’ Security Measures

In today’s mobile-centric world, the convergence of mobile devices, applications, and the Bring Your Own Device (BYOD) culture has enabled users, businesses, and organisations to achieve enhanced productivity, flexibility, and convenience. However, this transformation has also exposed individuals and organisations

Read MoreCTOS IDGuard Prevented RM319 Million in Fraudulent Loans Since 2020

CTOS IDGuard, Malaysia’s national fraud bureau, has flagged RM319 million in potentially fraudulent loan applications since 2020, using GBG’s fraud and financial crime prevention engine. The system has screened nearly 7 million applications from member banks, which cover over 65%

Read MoreHow the Financial Sector Can Capitalise on Consumer Security to Build Value

In the modern era, the average consumer spends around eight hours per day online, equating to a third of their lives. This ranges from work and shopping to socialising or merely relaxing, highlighting the ever-increasing relevance of online cyber security.

Read MoreDynamic Data Streamlines Customer Experience, Fights Fraud in Digital Banking

As the digital economy continues to surge and expand, consumer expectations for fast, secure access to products and services seem never-ending. Furthermore, when it comes to financial services, there is an entire generation of consumers cropping up who have barely

Read More