Maybank Launched 3 New Features To Help its 10 Million Users Plan Their Budgets

by Vincent Fong September 13, 2018Maybank announced the launch of their new digital financial planning tool on it’s online banking website, Maybank2u. The new tool is geared at helping their customers plan their savings, monitor their insurance and keep updated on their financial situation.

Commenting on the new features, Dato’ John Chong, Group CEO, Community Financial Services Maybank, said “The introduction of the new features are a natural extension of our commitment in creating services that put our customers’ needs first. It is an ambitious but simple objective of wanting to create the most user-centric and friendly financial platform for our customers.”

Commenting on the new features, Dato’ John Chong, Group CEO, Community Financial Services Maybank, said “The introduction of the new features are a natural extension of our commitment in creating services that put our customers’ needs first. It is an ambitious but simple objective of wanting to create the most user-centric and friendly financial platform for our customers.”

The financial planning tools include a Goal Savings Plan, Spending Tracker and an Insurance Dashboard.

Breaking Down the 3 Features

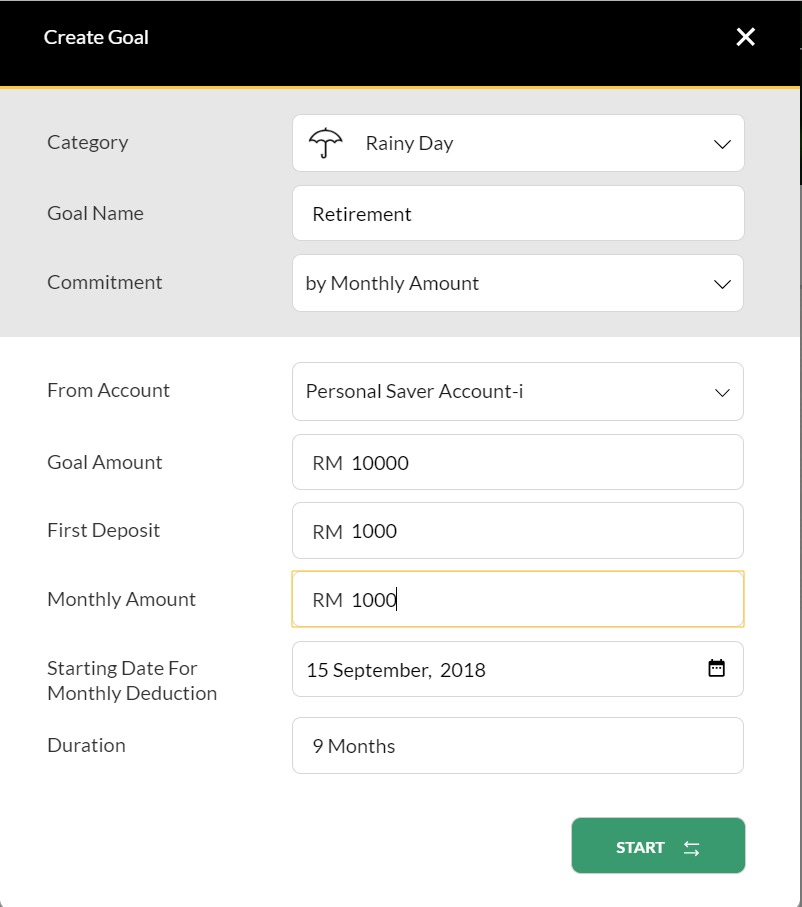

Goals Savings Plan

The Goal Savings Plan feature allows customers to segment their money into ‘goals’ without having to create separate accounts. Customers can create up to five goals and set a fixed monthly contribution which will then debited based on the time frame set by the customer.

Customers can at any time top up their Goal Savings Plan should they wish to fast track the goal achievement or save more than the desired amount

Dato’ John Chong, Group CEO Maybank told Fintech News Malaysia that they’ve seen over 4,500 goals created with RM 31.5 milllion to be saved since the pilot launch

Spending Tracker

![]()

The Spending Tracker feature allows customers to track spending from their debit and credit card. Customers are able to understand their expenses based on their card spending. This feature will allow them to have an overview on where they spent the most, helping them to manage and control their expenditure.

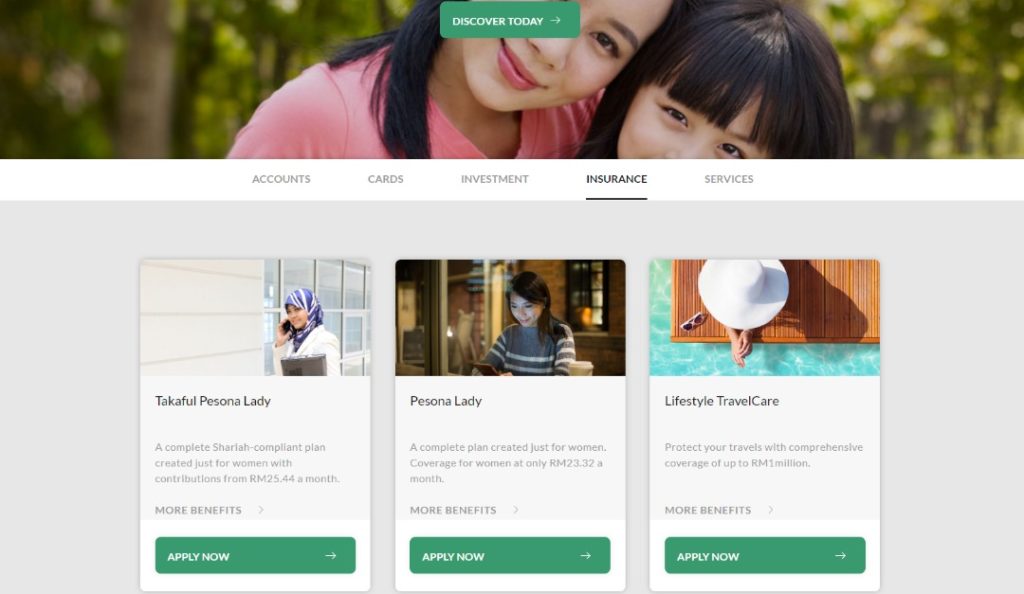

Insurance Dashboard

The Insurance Dashboard allows customers to view their purchased Etiqa Takaful Life and General Insurance policies in a single dashboard. This gives them an overview of their protection plans. They can also purchase Insurance and investment plans from Etiqa via their Maybank2u account.

Our Take

With over 40% Malaysians not planning ahead for their finances, digital finance management tools like the ones introduced by Maybank can prove to be quite useful.

The ability to auto-debit into your goals will help users to more regularly put aside money for whatever their goals are, however we feel the spend tracker should be also made available on their mobile app to give users the ability to view their finances real-time more conveniently.

The insurance dashboard could also be made even more useful if customers are able to view policies that they have purchased from other insurance companies rather just Etiqa, though from a business viewpoint one can see why Maybank would use this as another channel to cross-sell their insurance products.

For long time users of Maybank2u, you might be aware that this is not the first time that Maybank took a stab of digital financial management, in 2012 Maybank launched M2U planner with Perfectsen.

It might be interesting for our readers to note that CIMB has launched and enhanced their own digital financial management tool, CIMB EVA , not too long ago.