Why BNM’s Open API Initiative Could Bring Malaysia’s Fintech into a New Era

by Vincent Fong September 19, 2018Bank Negara Malaysia just released a proposed guideline for Open APIs in Malaysia, and is currently seeking feedback from the public. This follows Bank Negara Malaysia’s announcement earlier this year that it would be setting up an implementation group in the first quarter of 2018.

Bank Negara Malaysia’s Direction with Open APIs

There are three areas of focus for Open APIs in the financial services space in Malaysia namely; Motor Insurance/Takaful, Credit Card and SME financing (specifications can be found on their GitHub page).

The central bank’s key goals in this initiative are to improve SME’s access to financial products, push for liberalisation of motor insurance and takaful products, equalising the playing field for fintech companies and lastly, to use technology as a leverage for the distribution and consumption of financial products.

The document indicates that once this becomes policy, banks have a choice on whether to opt-in instead of a mandatory participation—though that may be subject to change down the line.

Why Open Banking is a Game Changer

Many would mark the start of the open banking revolution to UK’s Open Banking Work Group. The EU then followed with their PSD2 regulation where 9 of UK’s biggest banks have already participated in the Open Banking practice.

The deployment of Open Banking, in essence, breaks the bank’s monopoly on customer data and passes the power back to the consumer to decide who should have access to their data and what services can be provided based on the data.

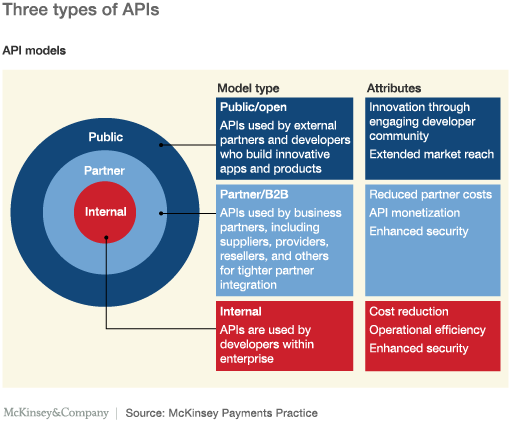

Open API Models

Here are several scenarios of how it could play out in real life—budgeting apps will no longer require users to manually key in their transactions if they are able to tap into your bank’s APIs and automatically populate the app with the user’s transactions.

Services like Maybank’s spending tracker and CIMB Bank’s EVA could also, in theory, provide consumers with a single view of all the finances with other banks and streamline their spending data into one platform.

While Open Banking is definitely a boon for consumers, some quarters have raised concerns about banks turning into “dumb pipes”. Others have viewed it as an opportunity for both fintech players and banks to come up with innovation never before possible.

Either way, with impending new policy, banks in Malaysia need to do some serious soul-searching to see where they should position themselves in this Open Banking world.