AWS and Mambu Share Their Guide to Cloud Migration for Incumbent Banks

by Fintech News Malaysia June 8, 2023In today’s rapidly evolving economic environment, businesses need to be able to adapt quickly to changing market and consumer demands.

This is especially true for traditional banks and financial institutions experiencing pressure to offer the same level of agility as their digital competitors.

The use of next-gen cloud native platforms is not exclusive to fintechs or neobanks – traditional banks can also harness these super agile platforms to supercharge operational agility and ensure there is no disconnect between front and back-end systems.

Across the globe, banks are choosing to migrate and gain an advantage with Mambu’s SaaS cloud native core, composable-API banking platform.

Source: Freepik

Composable-API platforms involve minimal coding, encouraging continuous service innovation without overburdening existing IT staff and systems.

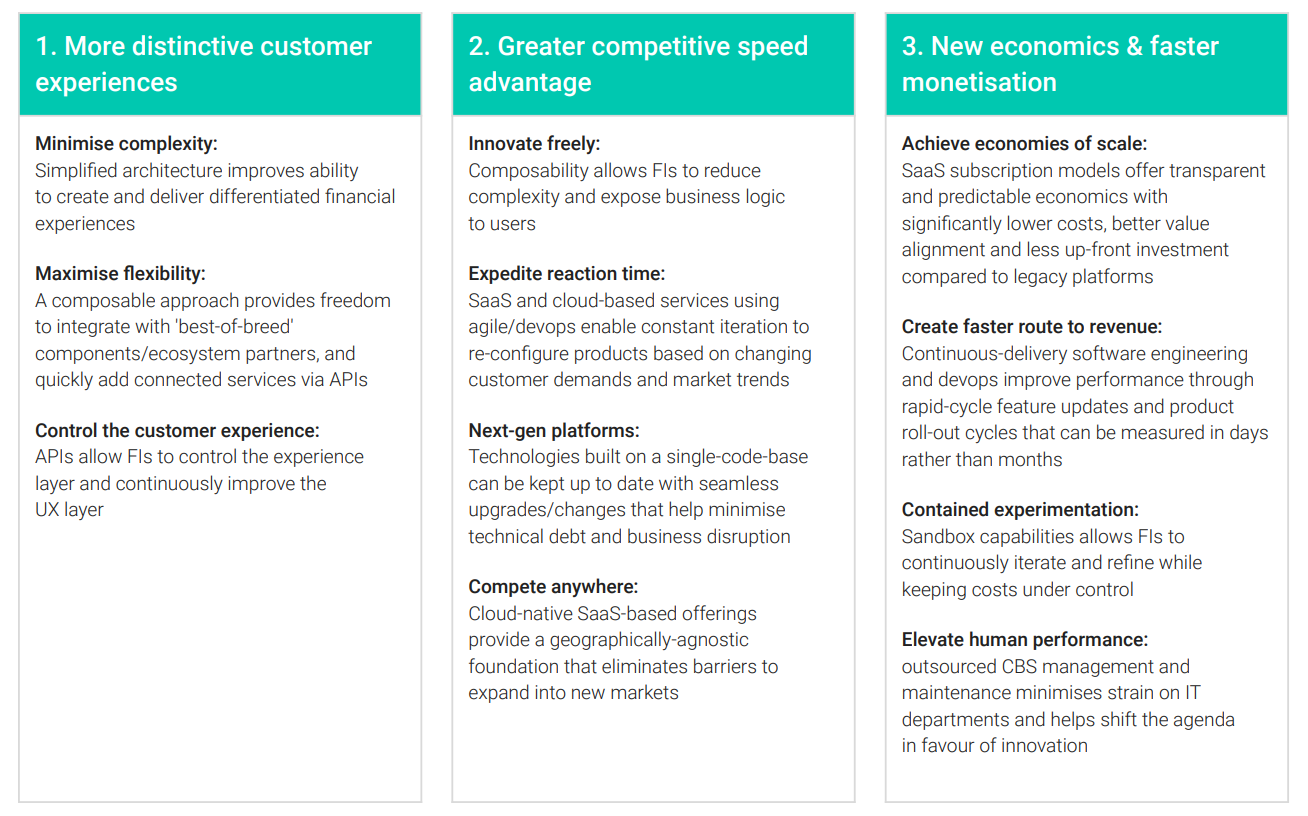

Utilising composable-API technology offers clear advantages to banks and FSIs looking to migrate bank services to the cloud, including more distinct customer experiences, greater competitive speed advantage and faster monetisation.

While most traditional banks understand that a move to the cloud is inevitable if they want to remain competitive, navigating that change can be overwhelming.

AWS and Mambu have produced a practical Cloud Migration Guidebook for traditional banking technology leaders and C-Suite executives who are considering cloud migration.

The rationale for change

Source: Freepik

In today’s technology-driven world, customers have come to expect their banks to provide better, faster, and more convenient ways to manage their finances.

Often hindered by legacy technology, traditional banks are facing increasing pressure to keep pace with innovative fintechs powered by agile and flexible next-generation technologies.

In this constantly shifting landscape, it’s clear that traditional banks need to migrate key back-end systems into the cloud to ensure increased speed, security and scalability.

Banks operating in the cloud benefit from:

· Enhanced security: Cloud providers have a laser focus on security, meaning banks operating in the cloud can be better protected from cyber-attacks;

· Improved scalability: Next-gen cloud native platforms are infinitely scalable, enabling banks to easily adapt to changing demand without having to invest in additional technology, so you can focus on growing the business rather than worrying about technology infrastructure;

· Reduced costs: Save money on tech costs, eliminating the need to purchase and maintain your own hardware and software, freeing up resources to focus on providing superior products and services.

However, transitioning from legacy infrastructure to cloud based is a complex exercise, so banks need to strike a balance between addressing the appetite for change while also making decisions about when to retire legacy technology (and associated technical debt).

Determining your cloud migration strategy

Source: Freepik

While there is no one-size-fits-all approach that will ensure success for every cloud migration, there is a common set of guiding principles that organisations can use to determine the correct strategy for their circumstances.

Five critical planning steps for successful cloud-based core banking migration detailed in the Cloud Migration Guidebook are:

- Define and commit to a vision

- Audit existing portfolio

- Build a viable business case

- Align organisation and culture

- Stress-test readiness and finalise plans.

A ‘dual core’ approach helps navigate bumps in the road

Even with a solid plan, migrating core functions to the cloud can be a challenging process.

While the end result will enable banks to achieve their long and short-term operational goals, barriers like high technical dept, increasing IT costs and runaway competition can distract from the task at hand and have a negative influence on decision making.

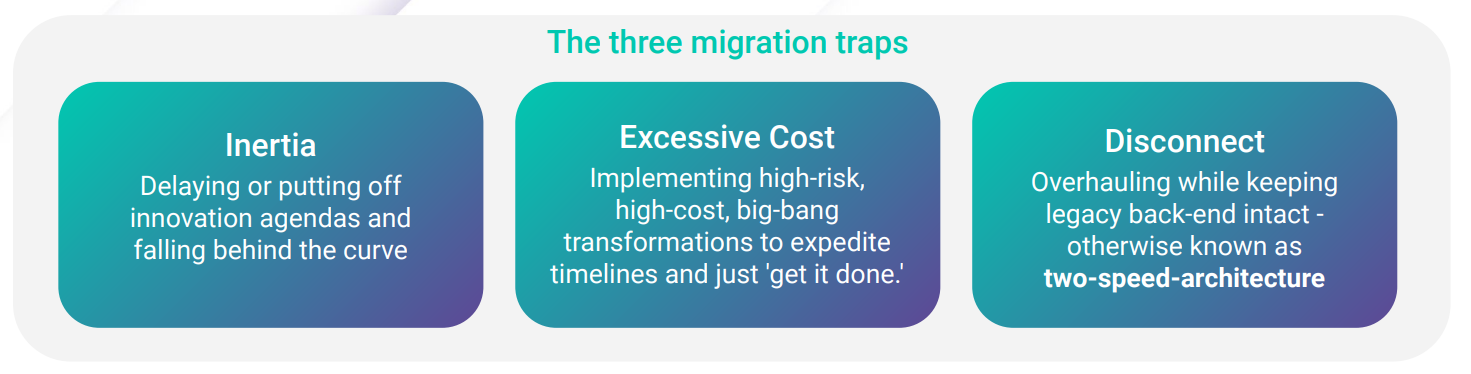

Common pitfalls that banks and FSIs should be aware of

So, how can banks avoid these migration traps? The answer is to choose a ‘dual core’ approach, where customers are progressively migrated, based on key events such as new product onboarding or product rollovers.

This approach sees the legacy core still supported for a set period – perhaps a year or two – but any new business growth, new products and new customers go straight onto the new cloud banking platform.

This approach is far less risky than a ‘big-bang’ rip and replace plan, and allows banks to go to market much sooner with exciting new products and services.

Starting from the core fast-tracks transition

Cloud-based operators use next-gen cloud-native core banking systems that leverage API-enabled technology to simplify IT, lower operating costs, provide greater flexibility and enable rapid experimentation.

Composable API technology offers three key advantages for those looking to migrate bank services to the cloud.

To succeed in today’s fast-paced financial markets, a ‘digital makeover’ is no longer enough.

Banks and FSIs need to become truly responsive to customer, operational and market needs by having every layer of the business operating at the same fast pace so the organisation can pivot, change, and innovate rapidly on demand.

Using a proven change accelerator platform such as Mambu’s core cloud banking platform running on AWS can help simplify the process, optimise performance, and accelerate results.

Download the step-by-step guide to seamless migration for incumbent banks developed by AWS and Mambu here.