Payments

BNM’s RENTAS Modernisation Plans to Futureproof Malaysia Payments Infrastructure

The Real Time Electronic Transfer of Funds and Securities System (RENTAS) represents a cornerstone of the financial infrastructure in Malaysia, facilitating the real-time gross settlement (RTGS) of large-value payments across the nation’s financial institutions. This pivotal system facilitates the seamless

Read MoreSoft Space Claims World-First to Bag Global MPoC Certification for SoftPOS Solution

Malaysian fintech Soft Space announced that its SoftPOS solution FasstapTM has been certified under the Mobile Payment Commercial Off-the-Shelf (MPoC) Solution Provider standards by the Payment Card Industry Security Standards Council (PCI SSC). The fintech claims to be the first

Read MoreNEXEA and PayNet Launch Accelerator to Support Malaysian Payment Startups

NEXEA, a venture capital and startup accelerator firm, has joined forces with Payments Network Malaysia (PayNet) to launch an accelerator programme. The PayNet Accelor programme aims to foster innovation in the country’s startup ecosystem, particularly focusing on digital transformation in

Read MoreMalaysia and Cambodia Regulators Ink MoU on Cross-Border QR Payments

The central banks of Malaysia and Cambodia have formalised a partnership aimed at advancing financial innovation and streamlining cross-border payment systems. The Memorandum of Understanding (MoU), signed by Bank Negara Malaysia (BNM) and the National Bank of Cambodia (NBC), was

Read MoreKTM Now Accepts E-Wallets, Debit and Credit Cards Across 80 Stations

The Malaysian Transport Ministry, led by Minister Anthony Loke, officially inaugurated the new open payment system for the Keretapi Tanah Melayu Berhad (KTMB) commuter services. Announced during a ceremony at the Ipoh Railway Station, the system is now operational across

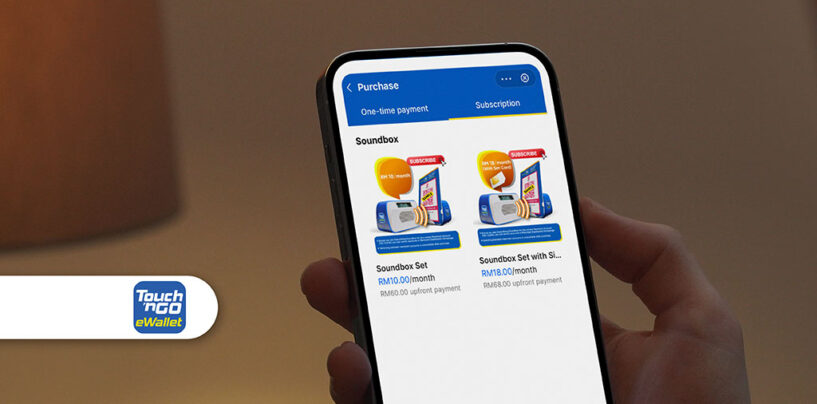

Read MoreTouch ‘n Go eWallet Offers Soundbox to Help Merchants Fight Scams From RM10/Month

TNG Digital has launched a new Soundbox device aimed at protecting merchants from payment scams through the Touch ‘n Go eWallet platform. The Soundbox device is available to merchants in two subscription models: a basic version for RM10 per month

Read MoreIs BNPL Shariah Compliant in Malaysia?

The Shariah Advisory Council (SAC) of Bank Negara Malaysia has taken significant strides in marrying the convenience of modern financial mechanisms like Buy Now Pay Later (BNPL) facilities with the rigorous principles of Shariah law. Through its comprehensive deliberations during

Read MoreTNG Digital and PayNet Teams up to Promote Digital Payments in Sabah

TNG Digital and PayNet Launch ‘Cashless Seja Bah!’ Campaign in Sabah to Promote Digital Payments TNG Digital and PayNet have initiated the ‘Cashless Seja Bah!’ campaign in Sabah, focusing on promoting cashless transactions. The campaign, launched at Gaya Street Night

Read MoreTrueMoney Now Supports DuitNow QR Payments

TrueMoney, a payments firm and subsidiary of Thailand’s Ascend Money, has expanded its services to include DuitNow QR code payments, allowing users to make seamless transactions at a wide range of merchants across Malaysia. This new feature is accessible via

Read MoreGHL Systems Goes Green With Roll Out of Digital Receipts

Payment solutions provider GHL Systems will gradually roll out digital receipts to its merchants in a bid to promote environmentally friendly practices in the retail sector. The digital receipt service aims to streamline transactions for both businesses and customers. It

Read More