Blog

Innovative Technology Remedies Almost 100% Of Payment Pain Points in APAC

The Asia-Pacific region, with 13 countries that process US$17.8 billion in digital payments per year, tends to invite issues as big as the region itself. As we kick-start 2023, banks and financial institutions (FIs) in the region will be pleased

Read MoreShopee’s Parent Company Sea to Create Over 2000 Jobs in Malaysia

Singaporean tech conglomerate Sea announced that it will be creating more than 2,000 in Malaysia as part of its expanded investment plan in the country. Sea operates three core businesses across digital entertainment, e-commerce, as well as digital payments and

Read MoreHelloGold Shutters Its Consumer Business — Users Have Until 2 Feb to Withdraw Funds

Malaysian-based fintech HelloGold, a savings app that blended gold trading with blockchain technologies, has become the latest casualty of adverse market forces and will be closing down its core business in Malaysia and Thailand. Users are given until 2nd February

Read MoreLuno Slashes 35% of Workforce as Crypto Fallout Rages On

Luno was the first digital assets exchange to be approved by the Securities Commission in Malaysia, opening the door for Malaysians to trade and store cryptocurrency assets in a more regulated setting. But as challenging macroeconomic factors adversely impact sectoral

Read MoreCIMB Debuts In-App Kill Switch to Suspend Accounts in a Suspected Breach

CIMB Bank and CIMB Islamic Bank has introduced a self-service ‘Lock Clicks ID’ feature which acts as a ‘kill switch’ for both its CIMB Clicks and CIMB OCTO apps. The new feature will enable customers to immediately freeze their online

Read MoreTouch ‘n Go Launches CSR-linked Numberless Visa Prepaid Card

Touch ‘n Go Group has partnered with Visa to launch a corporate social responsibility (CSR)-linked numberless prepaid card with a maximum transaction limit of RM5000 per day. With this card acting as a complementary payment channel to the Touch ‘n

Read MoreThe Growing Threat of Cybercrime as a Service to Asia’s Financial Institutions

The growth of internet usage, online banking, and digitalization of financial services has increased cybercrime and cyber criminals’ attack surface. Financial institutions are a prime target for cyber-attacks due to the large amounts of data and money they hold. In

Read MoreMalaysians Can Now Get Mobile Prepaid Top-Ups Directly From the BigPay App

BigPay, a Capital A venture company, has launched the prepaid mobile top-up feature so its Malaysian users can now top-up directly from their e-wallet balance. The feature is available for local telecom providers including Celcom, Digi, Hotlink, TuneTalk, U Mobile,

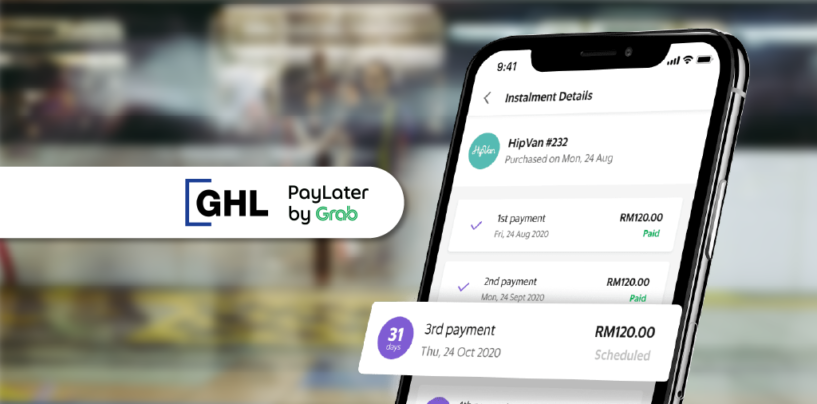

Read MoreGHL Rolls Out Grab’s BNPL Service PayLater for Physical Stores

Payment solutions provider GHL Systems will continue the rollout of Grab‘s Buy Now, Pay Later (BNPL) service for its in-store merchants following the enablement of PayLater back in 2021 for online purchases. PayLater by Grab gives consumers the flexibility of

Read MoreWill Ablr’s Ethical Approach to BNPL Stand The Test of Time?

”The “Buy Now, Pay Later” (BNPL) phenomenon has taken the world by storm. The concept is simple: customers can purchase and pay for items later, in installments, without accruing interest. BNPL has been a godsend for many people, allowing them

Read More