Payments

Ascertain Revamps RinggitPay With New Look and Enhanced Features

Malaysian fintech Ascertain Technologies has recently unveiled a revamped look for its flagship payment solution RinggitPay now with enhanced features as well. The rebranding and enhancement of RinggitPay aligns with Ascertain Technologies’ aim to streamline payment processes, ease administrative burdens,

Read MoreTNG Digital Enhances GOremit with Tranglo’s Cross-Border Payments Network

TNG Digital will leverage cross-border payment hub Tranglo’s network and infrastructure integration to enable its users send money directly from its digital remittance service GOremit on the Touch ‘n Go eWallet to 10 countries. The countries include Indonesia, the Philippines, Singapore,

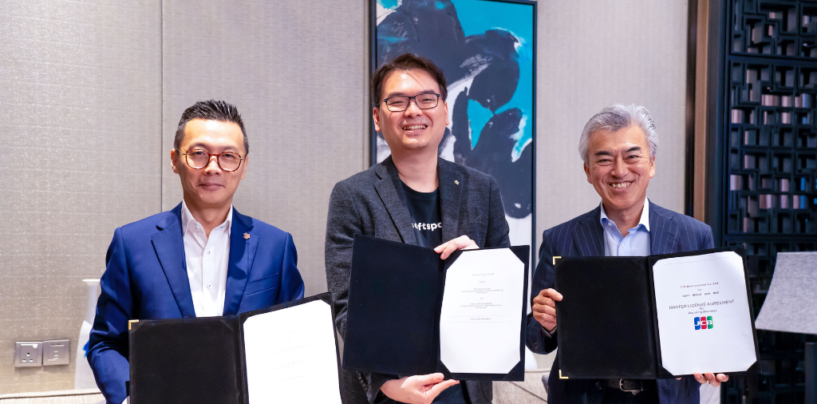

Read MoreJCB Card Acceptance in Malaysia Expands with Soft Space, Hong Leong Partnership

Malaysian fintech-as-a-service provider Soft Space has signed an agreement with Japanese credit card company JCB to enable the former to work with local acquirers such as Hong Leong Bank (HLB) to promote JCB Card’s acceptance in the country. Sofitel Kuala

Read MoreCIMB Enables Businesses to Pay Taxes Directly Through Its Online Platforms

CIMB Bank and CIMB Islamic Bank has integrated a new e-billing feature by Lembaga Hasil Dalam Negeri (LHDN) to make it easier for businesses to pay their taxes directly through the online banking platforms. The bank claims to be the

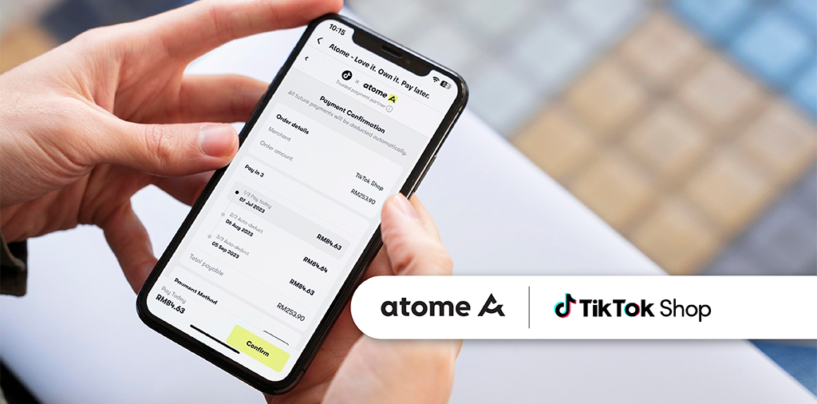

Read MoreAtome’s BNPL Payment Option Now Available on Malaysia’s TikTok Shop

TikTok Shop has integrated Atome‘s buy now, pay later (BNPL) payment option to bolster the e-commerce landscape in Malaysia. Consumers will have the flexibility to make purchases and spread deferred payments over three or six months with Atome now live

Read MoreTouch ‘n Go eWallet Users Can Now Send Remittance to 10 Countries

TNG Digital has launched its digital remittance services, GOremit in the Touch ‘n Go eWallet so its users can send money securely to ten countries. The countries are Indonesia, the Philippines, Singapore, Thailand, Vietnam, Bangladesh, India, Nepal, Pakistan, and Sri

Read MoreCurlec by Razorpay Transitions to Full-Stack Payment Gateway

Malaysian payments firm Curlec by Razorpay has transitioned from a dedicated recurring payments solution to a full stack payment gateway for businesses of all sizes. Indian payment gateway provider Razorpay had acquired a majority stake in the local fintech in

Read MoreTouch ‘n Go eWallet Users Can Now Pay for Street Parking in All KL, Selangor Areas

Touch ‘n Go eWallet now offers complete payment coverage for on-street parking in both Kuala Lumpur and Selangor areas. The newly enabled councils are the Majlis Perbandaran Klang, Majlis Bandaraya Seremban – Nilai, and Majlis Perbandaran Ampang Jaya. To make

Read MoreIs Your Organization Leveraging the Full Potential of ISO 20022?

The advent of ISO 20022 signifies a monumental shift in the financial world, a transition that promises unprecedented transparency, efficiency, and improved risk management. This financial standard elevates transaction data richness to a new level by offering up to ten

Read MoreTNG Digital Ties up With Bank Rakyat to Enable In-App JomPAY Bill Payments

Touch ‘n Go eWallet has formed a strategic partnership with Bank Rakyat to enable in-app bill payments via JomPAY. JomPAY is the nation’s bill payment service which is run and operated by Payments Network Malaysia (PayNet), the national retail digital

Read More