Sponsored

Stronger Mobile Application Security Is the Key to Revenue Growth

Financial institutions have been moving towards expanding digitisation for years, offering remote banking services, and prioritising the customer experience in digital platforms. In 2020, however, the COVID-19 pandemic has dramatically accelerated this shift. With less access to bank branches, the

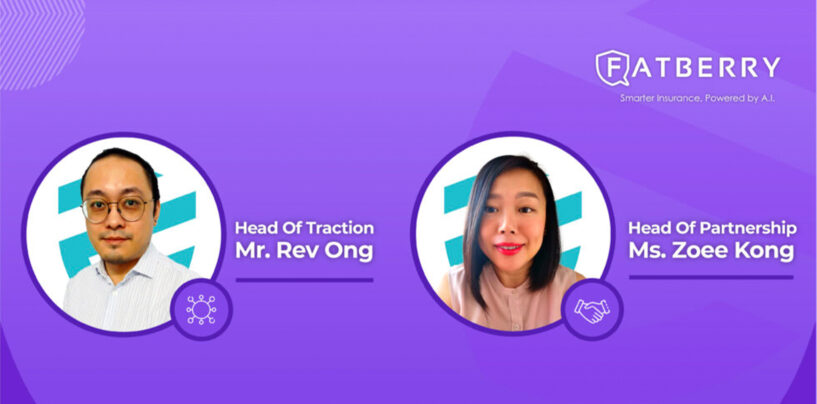

Read MoreInsurtech Fatberry Adds Senior Executives to Help Drive Growth

Malaysian digital insurance platform, Fatberry.com said that it has continued to experience strong growth and has recently added two senior executives to its management team to further drive growth. Ms. Zoee Kong, Head of Partnership, and Mr. Rev Ong, Head

Read MoreBanks Need to Ramp up Efforts To Win Over Digitally Savvy Muslim Customers

Banking and financial services platform Mambu released its research series named the Disruption Diaries which seeks to understand what people think of the key trends driving the development of financial services. In Mambu‘s third edition, the firm conducted a global

Read MoreDriving Financial Inclusion With BNPL and Smarter Decisioning

While news headlines broadcasting Buy Now, Pay Later’s (BNPL) incredible adoption trajectory are a daily occurrence, innovative lenders know that BNPL offers more than a growth story. It’s an opportunity to make headlines about how their business is empowering consumers

Read MoreMalaysia’s National Technology and Innovation Sandbox Admits Its First Fintech jomSETTLE™

jomSETTLE™, a fintech platform developed by Mazer Fintech Sdn. Bhd., announced that it is the first fintech to be admitted into the National Technology & Innovation Sandbox (NTIS) spearheaded by the Ministry of Science, Technology and Innovation Malaysia (MOSTI). The

Read MoreSynthetic Identity Theft Rises in Southeast Asia

Simply stated, synthetic identity theft is when a fraudster combines the personal information of different real-life people to create an authentic-looking digital identity. These identities can include Personally Identifiable Information (PII) such as name, identity card number, birth date and

Read MoreMalaysia’s High Financial Inclusion Rate Only ‘on Paper’, Mambu Says

A recent study of 2,000 global consumers by Mambu, a banking and financial services platform, revealed that both banked and unbanked individuals feel underserved, with 56% of banked customers claiming that there are other services they should be able to

Read MoreFICO: 61% of Malaysians Prefer Digital Banking Channels During Financial Hardship

Over the past year, companies have had to accelerate their digital transformation just to survive. Their investments were essential to retain customers, do business remotely, keep orders flowing and manage supply chains. While most companies are already on their way

Read MoreMalaysia’s INFOPRO Named as Best Core Banking Solution Provider in Banking Tech Awards

INFOPRO, the global banking software and solutions company, has been named winner of Fintech Futures’ Banking Tech Awards 2020 in the ‘Best Core Banking Solution Provider’ category. This prestigious award recognizes INFOPRO’s AI-driven Digital Banking platform – A new generation

Read MoreAlibaba Cloud’s New Report Urges Financial Institutions to Embrace Cloud Technologies

In Malaysia, a robust digital infrastructure and governmental support have enabled the growth of fintech startups and rising adoption of technology by financial institutions. With fintech becoming increasingly important in Malaysia’s financial sector, incumbents and fintechs alike are urged to

Read More